How to Identify and Avoid Cryptocurrency Scams

Introduction

Cryptocurrencies have gained massive popularity over the past decade, providing innovative ways to invest and conduct transactions. However, this surge in popularity has also attracted scammers looking to exploit unsuspecting investors. In this article, we’ll explore how to identify and avoid cryptocurrency scams to protect your investments.

Common Types of Cryptocurrency Scams

1. Phishing Scams

Phishing scams involve fraudsters impersonating legitimate companies or individuals to steal sensitive information. They often use fake websites or emails to trick you into providing your private keys, passwords, or other personal data.

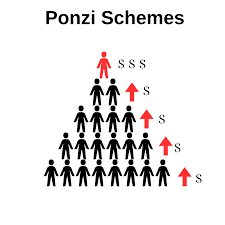

2. Ponzi Schemes

Use this code in Criptolia to claim article reward: PONZOSMAC

Ponzi schemes promise high returns with little risk, attracting investors who then recruit more participants. The returns are paid from new investors’ contributions rather than from profit. Eventually, the scheme collapses, leaving the majority of investors with significant losses.

3. Fake Initial Coin Offerings (ICOs)

Scammers create fake ICOs to raise funds for non-existent projects. They lure investors with promises of groundbreaking technology and high returns. Once they collect enough money, they disappear, leaving investors with worthless tokens.

4. Malware

Malicious software can be used to access your digital wallet or private keys. This malware often infects your computer through downloads or email attachments, allowing scammers to steal your cryptocurrency.

Red Flags to Watch Out For

1. Unrealistic Promises

Be wary of any investment opportunity that guarantees high returns with no risk. Cryptocurrencies are inherently volatile, and no legitimate investment can promise consistent gains.

2. Lack of Transparency

Legitimate cryptocurrency projects provide clear information about their team, technology, and business model. If a project lacks transparency or refuses to share details, it could be a scam.

3. Pressure to Invest Quickly

Scammers often create a sense of urgency to pressure you into making hasty decisions. Take your time to research and verify any investment opportunity thoroughly.

4. Unverified Partnerships

Check if the project claims partnerships with well-known companies or individuals. Scammers often fake endorsements to gain credibility. Verify these claims through official channels.

5. Poorly Written Whitepapers

A legitimate project will have a detailed, well-written whitepaper outlining its technology and goals. Be cautious of poorly written or vague whitepapers, as they may indicate a scam.

How to Protect Yourself

1. Research Thoroughly

Before investing in any cryptocurrency project, conduct extensive research. Check for reviews, expert opinions, and user feedback. Ensure the project has a credible team and a viable business plan.

2. Use Reputable Exchanges and Wallets

Stick to well-known, reputable exchanges and wallets. These platforms typically have stronger security measures and are less likely to be associated with scams.

3. Enable Two-Factor Authentication (2FA)

Always enable 2FA on your accounts to add an extra layer of security. This makes it harder for scammers to access your accounts even if they obtain your password.

4. Keep Your Private Keys Secure

Never share your private keys with anyone. Store them in a secure, offline location to prevent unauthorized access.

5. Stay Informed

Stay updated on the latest trends and news in the cryptocurrency space. Awareness of new scams and threats can help you stay vigilant and protect your investments.

Conclusion

While the world of cryptocurrency offers exciting opportunities, it also comes with risks. By staying informed and cautious, you can identify and avoid scams, ensuring your investments remain secure. Remember, if something seems too good to be true, it probably is. Always conduct thorough research and trust your instincts.

Post Comment