Crypto

backup wallet, blockchain security, crypto investment safety, cryptocurrency exchanges, cryptocurrency security, cybersecurity in crypto, digital currency protection, hardware wallets, multi-signature wallets, phishing scams, protect digital assets, secure crypto investments, secure your crypto, software wallets, two-factor authentication

Kayztr

0 Comments

How to Secure Your Cryptocurrency Investments

Introduction

Cryptocurrency investments can be highly lucrative but also come with significant risks. Ensuring the security of your digital assets is paramount to protect against theft, hacking, and other malicious activities. This article provides a comprehensive guide on how to secure your cryptocurrency investments and safeguard your financial future.

1. Use Reputable Exchanges

Overview

Choosing a reputable and secure cryptocurrency exchange is the first step in safeguarding your investments. Always opt for exchanges with a strong track record and positive user reviews.

Key Points

- Research the exchange’s security measures.

- Check for regulatory compliance and licenses.

- Use exchanges with robust customer support.

2. Enable Two-Factor Authentication (2FA)

Overview

Two-factor authentication adds an extra layer of security to your accounts by requiring a second form of verification in addition to your password.

Key Points

- Use apps like Google Authenticator or Authy.

- Avoid SMS-based 2FA, as it can be vulnerable to SIM swapping.

- Enable 2FA on all your exchange and wallet accounts.

3. Use Hardware Wallets

Overview

Hardware wallets are physical devices that store your private keys offline, making them less susceptible to online threats.

Key Points

- Consider wallets like Ledger Nano S, Ledger Nano X, or Trezor.

- Keep your hardware wallet firmware updated.

- Store your hardware wallet in a secure location.

4. Keep Software Wallets Secure

Overview

If you use software wallets, ensure they are from reputable providers and always keep them updated.

Key Points

- Use wallets with strong encryption and security features.

- Regularly update your wallet software to the latest version.

- Backup your wallet and store the backup in a secure location.

5. Backup Your Wallet

Overview

Backing up your wallet is crucial in case you lose access to your primary device. Always keep multiple backups in secure locations.

Key Points

- Backup your wallet’s seed phrase or private key.

- Store backups in multiple physical locations.

- Use encrypted and offline backups when possible.

6. Be Wary of Phishing Scams

Overview

Phishing scams are attempts to steal your sensitive information by posing as legitimate entities. Always be cautious of emails, messages, or websites asking for your credentials.

Key Points

- Double-check URLs and email addresses.

- Never click on suspicious links.

- Use browser extensions that block malicious sites.

7. Secure Your Devices

Overview

Ensuring the security of the devices you use to access your cryptocurrency investments is crucial.

Key Points

- Use antivirus and anti-malware software.

- Keep your operating system and applications updated.

- Avoid using public Wi-Fi for accessing your cryptocurrency accounts.

8. Use Strong, Unique Passwords

Overview

Using strong and unique passwords for your accounts helps prevent unauthorized access.

Key Points

- Use a password manager to generate and store passwords.

- Avoid using the same password across multiple sites.

- Regularly update your passwords.

9. Stay Informed About Security Threats

Overview

The cryptocurrency space is constantly evolving, and so are the security threats. Staying informed helps you take proactive measures.

Key Points

- Follow reputable news sources and security experts.

- Join cryptocurrency communities and forums.

- Keep an eye on updates from the exchanges and wallets you use.

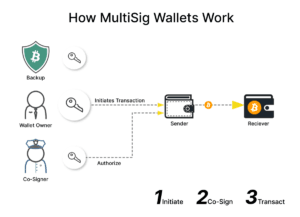

10. Understand and Use Multi-Signature Wallets

Overview

Multi-signature (multi-sig) wallets require multiple keys to authorize a transaction, adding an extra layer of security.

Key Points

- Set up a multi-sig wallet if you hold large amounts of cryptocurrency.

- Understand the process of using multi-sig wallets.

- Use multi-sig wallets for joint accounts or organizational funds.

Conclusion

Securing your cryptocurrency investments requires a proactive approach and a combination of various strategies. By following these best practices, you can significantly reduce the risk of losing your digital assets to theft or hacking. Stay vigilant, stay informed, and take the necessary steps to protect your investments.

Post Comment