The Benefits and Risks of Investing in ICOs (Initial Coin Offerings)

Investing in Initial Coin Offerings (ICOs) has become a popular method for early-stage funding of blockchain projects. While ICOs offer significant opportunities, they also come with substantial risks. This article explores the benefits and risks associated with investing in ICOs, providing you with a comprehensive understanding to make informed decisions.

Use this code in Criptolia to claim article reward: ICOPRODUCT

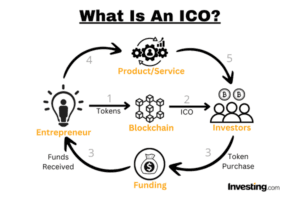

What is an ICO?

An Initial Coin Offering (ICO) is a fundraising method used by new cryptocurrency projects to raise capital. In an ICO, investors purchase tokens issued by the project, which can be used within the project’s ecosystem or traded on cryptocurrency exchanges.

Benefits of Investing in ICOs

- Early Access to Potential High Returns Investing in ICOs allows you to purchase tokens at an early stage, often at a lower price. If the project succeeds, the value of these tokens can increase significantly, providing substantial returns on investment.

- Supporting Innovation By investing in ICOs, you support innovative projects and technologies that have the potential to disrupt various industries. This involvement can be both financially rewarding and personally satisfying.

- Diverse Investment Opportunities ICOs offer a wide range of investment opportunities across different sectors, such as finance, healthcare, supply chain, and more. This diversity allows investors to create a varied portfolio that can mitigate risk.

- Liquidity Many ICO tokens are listed on cryptocurrency exchanges, providing liquidity to investors. This means you can buy or sell tokens relatively easily, compared to traditional investments.

- Participation in Decentralized Projects ICOs often support decentralized projects that operate without a central authority. Investing in such projects can be appealing if you believe in the principles of decentralization and blockchain technology.

Risks of Investing in ICOs

- High Volatility The value of ICO tokens can be extremely volatile. Prices can skyrocket or plummet in a short period, leading to significant financial gains or losses.

- Regulatory Uncertainty ICOs operate in a relatively unregulated space. Regulatory developments can impact the legality and success of ICO projects, potentially leading to losses for investors.

- Scams and Fraud The ICO market has been plagued by scams and fraudulent projects. Some ICOs have turned out to be exit scams where the founders disappear with the investors’ money. Conducting thorough due diligence is crucial before investing.

- Lack of Transparency Many ICO projects lack transparency regarding their operations, team, and progress. This can make it challenging to assess the viability and credibility of the project.

- Technological and Execution Risks Many ICO projects are based on new and untested technologies. There is a risk that the project may not be technically feasible or that the team may fail to execute their plans successfully.

Conclusion

Investing in ICOs can be highly rewarding but comes with significant risks. It is essential to conduct thorough research, understand the project and its team, and stay updated with regulatory developments. By weighing the benefits and risks, you can make informed investment decisions in the evolving world of ICOs.

2 comments